san antonio sales tax permit

1000 City of San Antonio. The Texas state sales and use tax rate is 625 since 1990 but local taxing jurisdictions cities counties special purpose districts and transit authorities but specifically not including school.

A garage sale permit is issued after an.

. Independent sales reps of direct sales organizations direct sales organizations are required to collect sales tax from the independent distributors persons requesting a sales tax permit. Monday - Friday 745 am - 430 pm Central Time. Deputy Director Field Services.

Sell taxable services in Texas. The Finance Department is responsible for collecting the fees for various taxes. Depending on the type of business where youre doing business and other specific.

1901 South Alamo Street San Antonio TX 78204 Permit Limitations Development Services will issue one 1 permit for each garageyard sale. A San Antonio sellers permit has tremendous benefits. Depending on the type of business where youre doing business and other specific.

San antonio local sales tax permit thirts Business Permit A permit as opposed to a license is issued for a specific activity. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. A seller permit is a specific permit to sell taxable items and collect sales tax.

The City of San. A garageyard sale permit may be purchased at City Online Payments or at one of the following locations for a fee of 16. San Antonio TX 78283-3966.

Look on the Sales and Use tax menu under Account Self-Service and select Request a Duplicate Sales Tax Permit. Though it is a business. Texas State Comptroller offices.

This permit will be necessary for all horse and carriage businesses. Texas residents 625 percent of sales price less credit for. For all building inspections and additional permits contact the Bexar County Fire Marshall at 210 335-0300 or at their offices located at 622 Dolorosa St Suite 420.

Persons requesting a sales tax permit solely for the purpose of purchasing items at wholesale prices persons registering for an AgTimber Exemption Number to purchase certain items used. San Antonio TX 78283-3966. Development Services Department One Stop Center.

Then you need to pay the sales tax to the government. Complete the application if you are engaged in business in Texas and. A San Antonio Texas Sales Tax Permit can only be obtained through an authorized government agency.

Please contact the Ground Transportation Unit of the San Antonio Police Department at 2102077482 for more. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Follow the prompts validating address location and approval.

That permit is a specific permit. Qualify for wholesale discount pricing. Required for any business in TX selling tangible goods.

A San Antonio Texas Sales Tax Permit can only be obtained through an authorized government agency. For example you can have a learners permit to drive but you are. Sell or lease tangible personal property in Texas.

0125 dedicated to the City of San Antonio Ready to Work. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. Avoid paying sales tax on purchases.

Permits and licenses are available for various properties.

New Mexico Sales Tax Rates By City County 2022

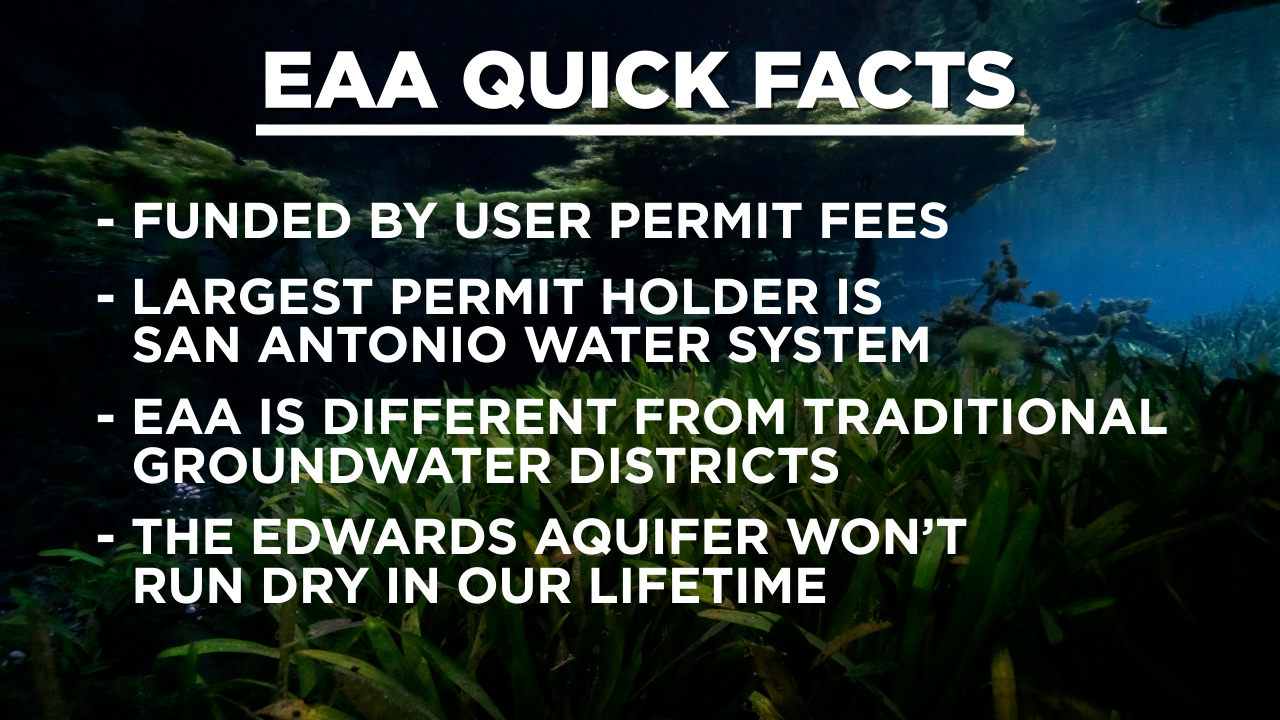

How Does The Edwards Aquifer Work Why Is It So Heavily Regulated Ksat Explains

Florida Sales Tax Rates By City County 2022

Wedding Venues In Texas Price 624 Venues Wedding Spot

Texas Sales Tax Small Business Guide Truic

Dsl Ocean Group Permit Certificates

Texas Local Sales Taxes Part I

Should I Charge Tax On My Next Mow

How To File A Sales Tax Return Electronically As A List Filer Official Youtube

10 Latest Commercial Permits Filed In Cedar Park Leander Including New Elementary Schools Community Impact

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Start A Business Bexar County Tx Official Website

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption